Glenigan, one of the construction industry’s leading insight and intelligence experts, has released its widely anticipated UK Construction Industry Forecast 2022-2024.

The key takeaway from this document, which focuses on the next three years – 2022-2024 – indicates the construction industry will face challenging economic conditions.

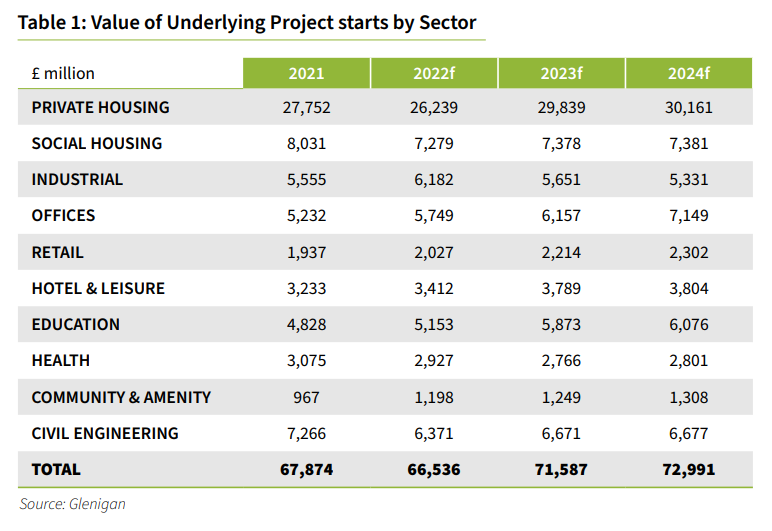

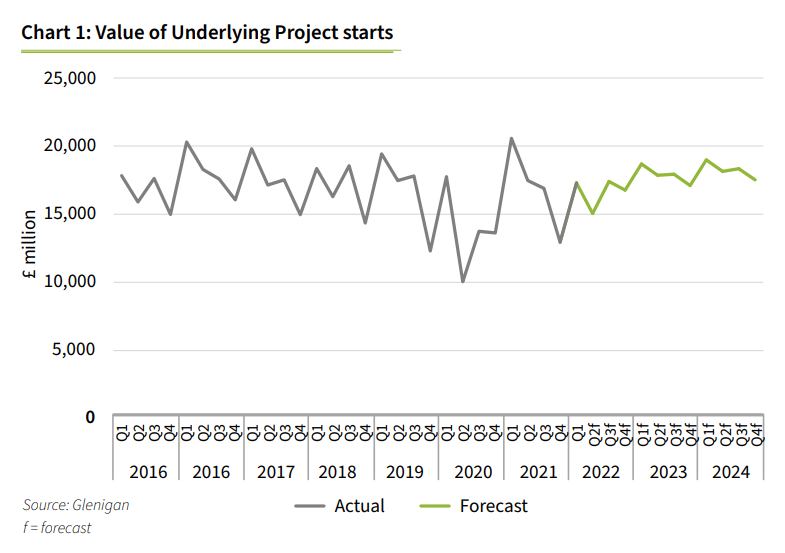

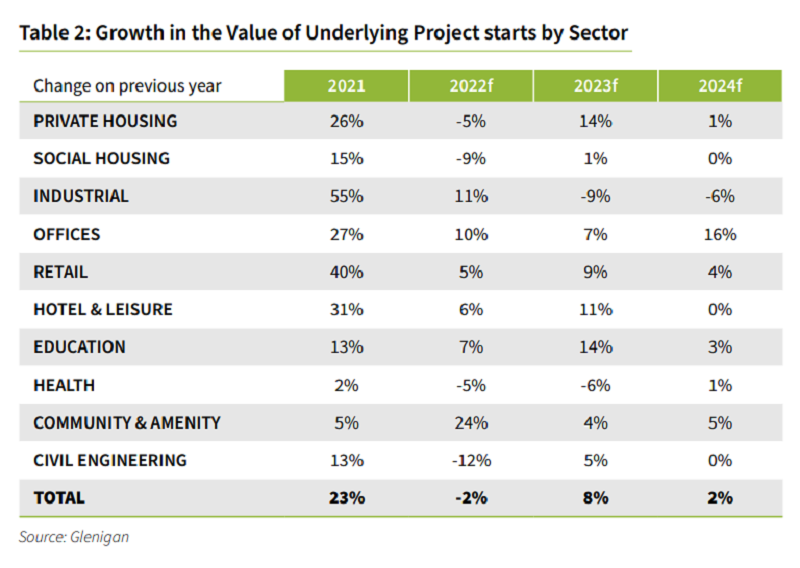

However, while growth will be stifled in 2022 – down 2% on the previous year, 2023 is predicted to see a modest 8% increase and a smaller 2% lift in 2024, representing an average rise of 2.6% over the forecast period.

The report is predominantly focused on underlying starts valued at under £100m and contains a comprehensive overview of the current state of the construction industry.

Crucially, it provides overall sector and vertical-specific insight into performance over the next few years.

Significant disruption stifles short-term growth

The next few years will be challenging for the construction industry as a whole, according to the forecast.

In particular, the war in the Ukraine is creating considerable economic uncertainty which is having a direct, current effect on output, derailing post-COVID recovery.

As a result, overall project starts are forecast to slip back 2%.

Aside from this ongoing conflict, current inflation spikes, higher taxes, and rising mortgage costs are expected to constrain activity in consumer-related areas, such as private housing, retail, and hotel and leisure.

In contrast, a firm development pipeline is predicted to lift industrial and office starts in 2022, as well as Government-funded areas such as health.

More positively, the value of project starts is expected to rise in 2023, as the UK economy stabilises and short-term supply chain pressure ease.

However the lingering impact of higher construction, material, and energy costs means this growth will be significantly lower than predicted in previous forecasts.

Public sector pick-up

Public sector investment is set to be an important driver for construction activity over the forecast period.

However, the latest Spending Review revealed only modest growth in capital funding for a handful of central Government departments over the next three years.

The outlook for the health sector is showing particular strength.

Project starts remained high in 2021, post-Pandemic, and the increase in capital funding and a growing development pipeline means the value of starts is expected to remain steady over the forecast period, will slight declines this year (-5%) and next (-6%) .

Commenting on the Forecast, Glenigan’s economic director, Allan Wilen, said: “Circumstances have changed significantly since the November 2021 forecast and, while the short-term picture appears challenging, we should adopt a sanguine approach for the next few years.

“Markets sent into turmoil by the Russia-Ukraine War are starting to stabilise as new supply chain solutions are developed and established.

“Of course, in the near future construction and building product costs will remain high. However, this situation will no doubt encourage a burst of imagination and innovation which will see the sector weather the current storm and progress to, if not sunny uplands, then at least towards a trajectory of upward growth.”

Speaking to BBH about the health sector, he added: “There will be a slight decline in healthcare starts in 2022/23 because we have seen substantial growth as a result of the pandemic, in particular the huge investment in Nightingale hospitals, which created a false high for the sector going forward.

“However, there has been a substantial rise in capital funding and NHS trusts are bringing forward new projects and investment plans, including the Government’s plans for 40 new hospitals.

“We do expect a slight dip in project starts, but there is an air of opportunity.”