Despite a slowing of the market in recent months, experts predict billions will be spent on healthcare construction over the next five years, providing a wealth of opportunities for designers, builders and product developers.

The Government’s National Infrastructure and Construction Pipeline, published in December, details more than £460bn of planned public and private infrastructure investment, with a total projection of around £600bn over the next 10 years.

Investment in ‘social infrastructure’, which includes hospitals and other health and care facilities, lists 184 separate projects with a total value of £43bn.

Of those projects, five are healthcare related and worth £8.5bn to 2020/2021. Another £3bn worth of projects are expected beyond 2021, making a total pipeline worth in the region of £11.5bn.

Fit for the future

Specific projects listed include estate improvements at Brighton and Sussex University Hospital, and the document, while mainly focusing on small-scale schemes, does not rule out significant future investment.

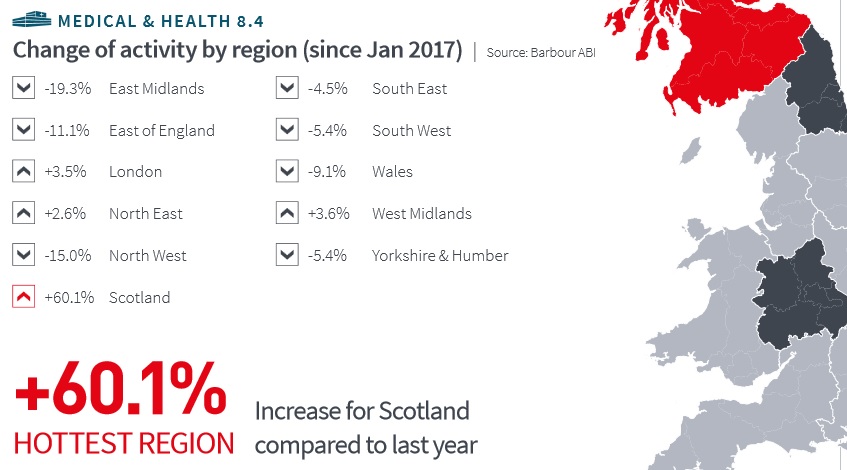

While there has been some variation in monthly contract awards in 2017, it is evident that activity in the medical and health sector is at a much lower-level than 2015 and early 2016

It states: “The NHS estate needs to be fit for the future and suitable for modern methods of care.

“This means making best use of the existing estate, as many small-scale projects up and down the country have been doing.

“However, where needed, or where it represents better value for money, there will also be wholly-new facilities.

“Last year the Alder Hey Children’s Health Park in Liverpool won the 2016 Prime Minister’s Better Building Award. Work also began last year in Brighton to replace the oldest inpatient ward block in England. And construction continues on new hospitals in Birmingham and Cambridge, with the new Papworth Hospital site due to open in spring 2018.”

And, in his autumn budget, the Chancellor announced a £10bn investment in existing NHS buildings, new facilities and the modernisation of patient care. £3.5bn will be made available for the estate between now and 2020, with the extra £6.5bn coming from sale of surplus assets to developers.

Scotland has seen the most construction activity over recent months

Battling Brexit

This is expected to help meet the Government’s pledge to build thousands of new homes up and down the country.

There is also a lot of interest in the new ProCure22 framework, which will see a £4bn investment in the NHS estate between now and 2020.

Research from construction industry analyst, Barbour ABI, shows opportunities particularly in the South East of England and Wales, with primary and social care expected to be key markets moving forwards.

And, despite ongoing concern over the impact of Brexit on the construction industry as a whole, and an overall reduction in capital schemes starting on site; the long-term opportunities within the healthcare sector are expected to improve.

Going forward the key construction opportunities in the healthcare sector are likely to be in the primary care sector - including GP surgeries and community health centres - and this may entail further opportunities for the development of hub facilities and integrated GP premises

According to Barbour ABI’s most-recent Economic & Construction Market Review, published in February, health sector construction contract award values increased by 25.2% in January compared with December, with total value of £126m based on a three-month rolling average.

However, comparisons with January 2017 show a 2% overall decrease. And, in the three months to January this year the total value of contracts awarded was £368m, a decrease of 14.7% on the previous three-month period.

“While there has been some variation in monthly contract awards in 2017, it is evident that activity in the medical and health sector is at a much lower-level than 2015 and early 2016,” the report states.

It adds that Scotland ‘completely dominated’ medical and healthcare construction in January, with a 71% of the market, an increase of 60% on January 2017.

One of the key contract awards was the £50m Baird Family Hospital in Aberdeen.

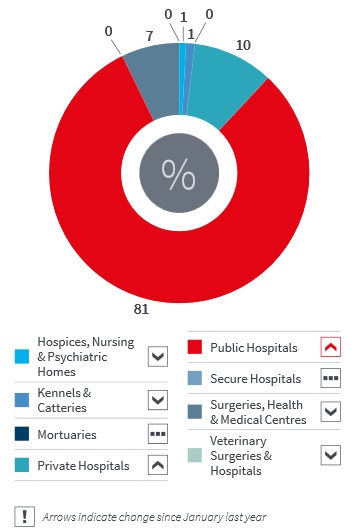

Most of the spending is on public hospitals

The lion’s share

The project, to be led by John Graham Construction, is due to start on site in the next few months and will provide new maternity and gynaecology services.

Meanwhile, Kier Scotland has been awarded the £34.5m contract for the expansion of the Golden Jubilee Nation Hospital in Clydebank, which is due for completion at the end of 2021.

The only other region with a notable share of contract awards was London, with 10.5%, an increase of 3.5% on January 2017.

Notable contract awards in other regions included the £6.2m new sterile services department at Broadgreen Hospital in Liverpool; and the £2m extension of St Richards Hospice in Worcester, which was awarded to Stepnell.

In terms of the types of projects coming to site; contract awards so far this year have been dominated by public hospitals, with a 81% share, an increase of 22% on January 2017.

The second-largest sector was private hospitals, with 10%, which compares to 1% in January 2017.

Surgeries, health and medical centres held 7% of contract awards in January 2018, a decrease of 15%.

Contractors will also be waiting to see how new procurement routes and private finance initiatives will be used to procure work in the health sector moving forwards

The three top health and medical clients in the year to January were Aneurin Bevan Health Board, with overall project values of £220m; NHS Grampian (£108m); and Frimley Health NHS Foundation Trust (£78m).

The most-active architectural companies were BDP, Norr, and Pozzoni Design Group; while the top contractors were Kier Construction, Interserve, and John Graham Construction.

AMA Research records around 10 large NHS-led programmes currently underway.

A spokesman said: “Going forward the key construction opportunities in the healthcare sector are likely to be in the primary care sector - including GP surgeries and community health centres - and this may entail further opportunities for the development of hub facilities and integrated GP premises.

“In the acute and secondary sector, much of the medium-term is expected to lie in refurbishment and extensions, with very few big new hospitals planned for development.

“The introduction of ProCure22 should mean a continued focus on partnerships to drive increased efficiency and productivity, while lowering construction and maintenance costs.

Overseas opportunities

“Contractors will also be waiting to see how new procurement routes and private finance initiatives will be used to procure work in the health sector moving forwards, with the expiration of the Express LIFT framework and both the DH and CHP currently working to explore future options for health PPPs.”

But it’s not just the UK where there are opportunities to be had.

Coming to the end of two decades of significant investment in healthcare infrastructure; the UK has much expertise to offer overseas.

Key markets are expected to open up in India, China and the United Arab Emirates, while Denmark is currently undergoing the biggest building project since its 14th-century church-building scheme within the healthcare market.

There is great potential for non-Danish companies to secure attractive tenders within a wide variety of business areas

Of the 16 nationwide projects currently planned, seven super hospital new-build, extension and modernisation projects in Greater Copenhagen are still open for tenders. Budgets range from €87m to €0.9bn.

Kim Fønss-Lundberg, investor development manager at Copenhagen Capacity, which assists foreign businesses, investors and talent in identifying and capitalising on business opportunities in Greater Copenhagen, said: “There is great potential for non-Danish companies to secure attractive tenders within a wide variety of business areas.

“89% of foreign companies winning a tender in Denmark have Danish representation, so establishing a business presence in Greater Copenhagen can be a wise investment.”