The dearth in healthcare construction projects is now ‘more than just a blip’, according to experts, with data showing the value of contracts was less across the whole of the last quarter than in a single month last year.

Barbour ABI’s monthly Economic Construction Market Review, published last month, shows that In August this year, the value of medical and health construction contract awards remained below the £100m threshold for the third consecutive month, at £73m, based on a three-month rolling average.

This is 5.7% lower than July, and also 21.3% lower than in August 2018.

In the three months to August 2019, total medical and health contract awards were valued at £220m; 53.8% lower than the previous quarter and 34.7% lower than for the comparable quarter ending in August 2018.

The report states: “Contract awards within the medical and health sector remain subdued and have reduced considerably over the last 18 months.

“To provide perspective, the total quarterly value for June to August 2019, at £220m, is now less than the monthly value of £229m for April 2018.

“The outlook continues to remain muted.”

In a recent report the Office for National Statistics (ONS) revealed that construction output across all sectors had fallen by 0.8%, driven predominately by a fall in repair and maintenance of 2.2%, with a minor contribution from a 0.1% fall in new work.

New orders in the second quarter of this year fell by 13.3%, reversing the increase of 10.4% in the first three months of the year.

All sectors apart from infrastructure experienced a decrease in comparison with the first quarter of the year.

Overall, the ONS reports that construction output decreased by £333m in the three months to July 2019, compared with the previous three months.

Commenting on the report, Clive Docwra, managing director of leading construction consulting and design agency, McBains, told BBH ongoing uncertainties over Brexit were largely to blame, adding: “Longer-term trends show growth on a downward trajectory.

“For that reason, the industry will not be getting overly excited.

“The continuing Brexit soap opera, the events of which become more bizarre and unpredictable daily; mean that spending decisions will continue to be put on hold until investors are more confident of the road ahead.

The continuing Brexit soap opera, the events of which become more bizarre and unpredictable daily; mean that spending decisions will continue to be put on hold until investors are more confident of the road ahead

“Meanwhile, the weak pound means the cost of imported materials is squeezing pockets.

“All the signs point to a protracted slowdown in activity over the coming months.”

And Martin Bennison, head of construction at Ultimate Finance, said: “The figures show the UK construction industry’s shrinkage is now more than a blip.

“The downturn indicated at the beginning of the year is now persistent, with output continuing to fall throughout Quarter 2.

“This trend is mirrored in the number of enquiries coming into our specialist construction team.

“We’ve seen a 300% increase on this time last year in funding enquires from primarily supply chain companies looking for invoice finance facilities to shore up their cashflow.”

And he warned: “When politicians and economists reflect on these figures, it would be prudent for them to remember that the figures cited in the report are being reflected on the ground, and are literally affecting people’s livelihoods.”

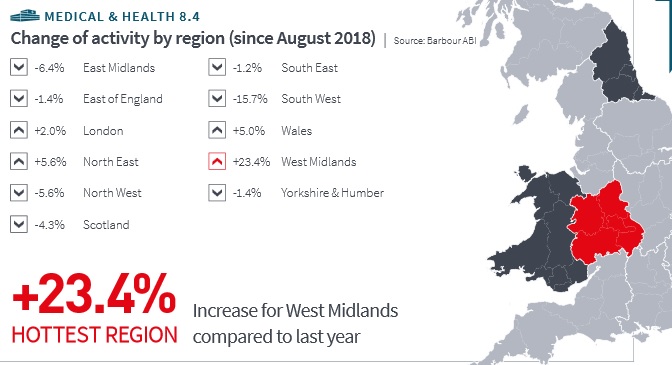

In terms of healthcare contracts, the Barbour ABI report states that the low level of contract awards means the regional analysis is influenced by the award of higher-value single contracts.

The leading region in August was London, with a 45.3% share of contract awards, with share value having increased by 2.0% compared with August 2018.

The largest contract award in London in August was for the £24.9m Douglas Bennett House at Maudsley Hospital Mental Health Facility in Camberwell.

The project will involve the demolition of the existing building and the completion of a new five-storey structure to provide a new inpatient mental health facility with eight wards.

The contract was awarded to Integrated Health Projects, a joint venture made up of Vinci and Sir Robert McAlpine.

When politicians and economists reflect on these figures, it would be prudent for them to remember that the figures cited in the report are being reflected on the ground, and are literally affecting people’s livelihoods

The West Midlands was the second-largest region, taking a 24.1% share of contract awards, compared to just a 0.7% attributable share a year ago.

The largest contract award for the region this month was the £9.9m Queens Hospital Ward Extension in Burton on Trent.

Awarded to Catfoss Group, the contract will involve the building of a three-storey structure with total floor areas of 3,967sq m to provide new treatment rooms, waiting areas, offices, and storerooms.

Only three sub-sectors saw contract awards this month.

With a dominant 71.3% share of awards, public hospitals were the leading sector in August, with the attributable share having increased by 15.9% on a year ago.

Hospices, nursing and psychiatric homes were the second-largest sector, with share of 15.4%, but this is a 5.5% decrease on August 2018.

The only other sector with any share of medical contract awards this month was surgeries, health and medical services, with 13.3%, which is an increase of 1.1% on August 2018.

The total quarterly value of healthcare construction projects in the three months to August was less than the monthly value for April 2018