For compliance professionals in medtech companies with a presence in Europe – or the ambition to bring their products into the European market – the new European Medical Device Regulation (MDR) is a matter which should be high on their agendas in 2018.

This represents the single-largest change to medical device regulations in Europe since CE Marking was introduced in 1993, which gives some indication of the scale of the changes facing the industry

The new regulation, which was published in May 2017 and will come into force by 2020, is a very-complex and lengthy document and the changes which it embodies are significant. For this reason medical device manufacturers need to start preparing as soon as possible to comply with this unprecedented change in the European regulatory landscape.

The rules aim to enhance clinical safety while improving fair market access for all medtech, large and small.

It represents the single-largest change to medical device regulations in Europe since CE Marking was introduced in 1993, which gives some indication of the scale of the changes facing the industry.

Specifically, the MDR requires manufacturers to address new technical documentation standards; reclassification including legacy products; reprocessing of single-use devices; clinical evaluation/evidence standards; vigilance and post-market surveillance; mandatory product liability insurance; transparency through EUDAMED; labelling & the supply chain; and unique device identification (UDI).

Despite the fact that the regulation will not be fully enforced until 2020, there is growing recognition that the necessary preparatory and compliance work needs to start now.

This is not merely due to the extent and complexity of the changes. There is a major capacity bottleneck looming when it comes to both in-house compliance professionals and the Notified Bodies (NBs) responsible for certification within the medtech industry.

It is clear that manufacturers needing to obtain recertification of their CE Marking could find themselves caught out by this

The in-house shortage is part of the wider skills gap in the life sciences industry, which is especially acute for clinical trial and compliance professionals.

The MDR will certainly compound this existing issue. Similarly, many commentators have highlighted that the regulation will overstretch Notified Bodies (NBs), which are already under pressure, and which themselves are obliged to seek designation under the MDR due to previous safety concerns.

Some have already stated that they are not providing quotations for new CE Marking work, while others have quoted lengthy lead times.

It is clear that manufacturers needing to obtain recertification of their CE Marking could find themselves caught out by this.

There is rising cause to believe that late compliance movers may struggle to recapture the market share that they lose to the pioneers

Compliance outsourcing offers a potential answer, but even here it will pay to move quickly because available resources will also run short.

It is clear that early compliance movers will give themselves the best chance of avoiding capacity and timing issues. But, even more importantly, we believe they will be at a significant commercial advantage over late movers because the latter may find themselves temporarily excluded from markets that they are not certified to service.

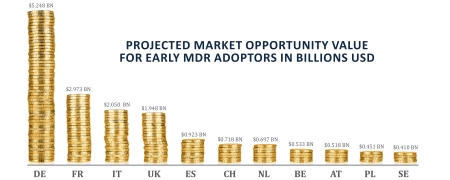

Just how significant is this opportunity? We formulated a calculation – which we have coined the MDR Market Opportunity Value (MOV) model – in order to put hard figures on the scale of the advantage available to compliance first-movers.

Assuming compliance under-capacity is around 20% of total market value, our model shows that the value of the medical devices markets available to fully MDR-compliant manufacturers is $16.5 billion. This spans the EU’s 10-largest economies plus Switzerland. Conversely, this could be considered the value of lost revenues facing non-compliant medtech firms.

So what steps should manufacturers take? We would recommend developing and implementing a pro-active and pragmatic MDR compliance strategy as soon as possible.

Medtech firms’ competitive position could be under threat if they do not tackle the MDR sooner rather than later

This will usually involve appointing team members from different departments across the business to ‘own’ certain processes.

It is necessary to conduct a full audit of the product portfolio and eliminate any products deemed unnecessary. For many firms, the best option will be to partner with external compliance experts who can guide them through the process and help to develop a watertight action plan. Certainly, Notified Bodies will need to be booked in for certification work as soon as they are compliant themselves.

There is rising cause to believe that late compliance movers may struggle to recapture the market share that they lose to the pioneers.

This highlights that medtech firms’ competitive position could be under threat if they do not tackle the MDR sooner rather than later.